News, Events & More

Plankowner Campaign update

Posted: 1/26/2023

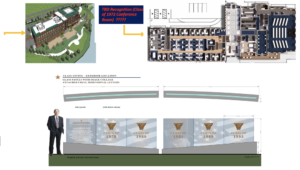

THE PLANKOWNER CAMPAIGN, AS PART OF THE NEW ALUMNI ASSOCIATION & FOUNDATION CENTER PROJECT, WRAPPED UP AT THE END OF 2022 HAVING RAISED $17 MILLION. IT WAS A BIG SUCCESS.

AS I REPORTED AT OUR OCTOBER CLASS REUNION MEETING, OUR CLASS RAISED ABOUT $800,000 FROM 61 CLASSMATES. WE HAVE APPROXIMATELY 22 PLANKOWNERS, AND WE QUALIFIED FOR CLASS RECOGNITION AT A HIGHER LEVEL, WHICH CAN BE VIEWED BELOW, OR here.

WE ALSO EARNED NAMING RECOGNITION FOR ONE OF THE CONFERENCE ROOMS, WHICH CAN ALSO BE SEEN BELOW.

THE PROJECT FINISHED WITH OVER 1100 PLANKOWNERS, WITH THE CLASS OF ’67 HAVING 115, FOLLOWED BY THE CLASS OF ’75 WITH 80.

I’M INCLUDING A LIST OF ALL OF THE 22 PLANKOWNERS FROM OUR CLASS, WITH A REQUEST THAT YOU REVIEW THIS, AND ADVISE ME IF YOU THINK WE’VE MISSED ANYONE THAT SHOULD, IN FACT, BE INCLUDED. THE CRITERIA IS ANY INDIVIDUAL WHO DONATED $12,500 OR MORE TO THE PROJECT QUALIFIES AS AN INDIVIDUAL PLANKOWNER. 22 OF OUR 61 DONORS MET THIS CRITERIA, ACCORDING TO OUR RECORDS.

MY THANKS TO ALL OF YOU THAT CAME THROUGH AND MADE THIS LATEST CAMPAIGN A SUCCESS FOR THE CLASS!

JEFF BEARD

John M. Dillon, John K. Welch, Gary G. Groefsema, Nelson M. M. Jones, William L. Sheppard, Jeffrey R. Beard, Richard T. Boeshaar, Ray A. Ritchey, Gerard R. Bodson, Thomas D. Jones, George E. Voelker, Webster L. Benham, John J. Keenan, Rodney K. Womer, Joseph V. Bridgeford, Gary M. Hall, Glenn E. Reitinger, Todd C. Nichols, Jerome P. Boyle, Richard M. Gutekunst, Lawrence H. Kubo, Robert D. Loeffler, Kenneth A. Paul, Yelena Dillon, Michele M. Welch, Roberta Groefsema, Ebru Sheppard, Cecily Beard, Emily Boeshaar, Anne Ritchey, Brenda L. Joyner, Deanna L. Jones, Linda L. Benham, Gayle C. Keenan, Barbara Karplus, Cynthia K. Bridgeford, Betty J. Hall, Beth Reitinger, Christine Nichols, Joan Boyle, Anne P. Gutekunst. Carmen E. Kubo, Janet Loeffler, Holly G. Paul

Ship’s Store Final

Posted: 11/1/2022

Classmates,

Even though our fabulous 50th Reunion is history, you can still get merchandise from the Class of ’72 Ship’s Stores. If you bought ’72 gear prior to the reunion and want another polo shirt, jacket, etc., or if you didn’t order anything or could not attend the reunion, the stores are still open!

For clothing items, orders will be accepted until Friday, December 2, 2022, at www.usnaclasstore.com/72store.html. After December 2, this store will be closed.

For mugs, glasses and other items, there is no cutoff date. Orders will be accepted for the foreseeable future. You can order a reunion “package” at https://www.foreverfirstie.com/product/class-packages. If you prefer ordering single items rather than the ’72 package, go to https://www.foreverfirstie.com/product/yeti-mugs. Any item can be customized so order whatever you’d like and describe the details of your request in the notes section at checkout.

Once again, don’t delay ordering clothing items…December 2 is your last chance!

Tried and true with ’72!

June 2022 update: Class of ’72 Plank-Owner Campaign Project

Posted: 6/15/2022

So close…and yet so far away

Welcome to summer 2022, and only four months until our 50th reunion in October. At the class business meeting, I’ll provide a report regarding how we’ve done with respect to our last successful campaign (the ’72 Athletic Facility & Excellence) and our current Class of ’72 Plank- Owner Campaign. By the way, I’ll also be leading a tour during the weekend of Rickett’s Hall and the Class of 1972 Sports & Rehabilitation Centre, so watch for further details.

In summary, our last campaign (which is finishing up this year) has gone great. We set a goal of $5 Million, we’re now just around $7 Million, and almost half of you are participating. No other class in the history of USNA has achieved this!

However, our current campaign (goal of $750K) needs some help. We’ve raised $650K with 55 classmates participating….so close! Can we close the gap before the reunion?

First some background on our current campaign:

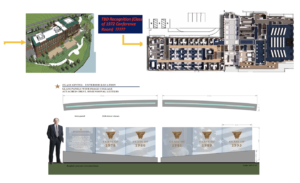

- We’re raising funds for the new Alumni Association & Foundation Centre (AAFC – see image below), which is currently being constructed outside the Yard & across the road from the baseball field. It’s a $36 Million project. Many classes are helping to fund it.

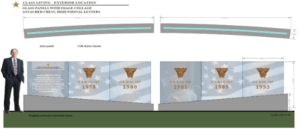

- Our $750 K will go toward: (1) A class naming opportunity ($500 K) for a conference room AND (2) a $250 K class major “plank-owner” plaque that would be displayed with other class plaques in the North Garden Terrace (see images below). Funds raised so far mean we have either the “plaque”, or the conference room…but not both.

- For those of you that pledged a full five years to our last successful campaign, your last pledge comes due this year (2022). Please consider extending your pledge to this new campaign from 2023 onward (up to five years). Here’s a link to our class pledge form, which can be filled out online, saved, and sent directly to USNA via an e-mail: http://www.bit.ly/72pledgeform

The facility—targeted to open in 2023—will provide a premium venue for a wide range of alumni events, enhance Alumni Association and Foundation operations, and providing ideal space to celebrate alumni achievements.

- Some of you with IRAs might consider using a portion of your required minimum distribution (RMD)

which begins for us at age 72. Your RMD will be counted by the IRS as income, meaning you’ll need to report it for both state and federal taxes. HOWEVER, if you use all/some of your RMD as part of a qualified charitable deduction (QCD), you to avoid paying taxes on the amount being donated. Here’s a link with more information on the QCD: http://www.usna.com/plannedgivingIRAQCD.

which begins for us at age 72. Your RMD will be counted by the IRS as income, meaning you’ll need to report it for both state and federal taxes. HOWEVER, if you use all/some of your RMD as part of a qualified charitable deduction (QCD), you to avoid paying taxes on the amount being donated. Here’s a link with more information on the QCD: http://www.usna.com/plannedgivingIRAQCD.

Now, here’s the kicker. One of our classmates has made a commitment that he’s willing to match, dollar for dollar, any pledge up to a cumulative $50K! So, if those of you out there on the fence, and already thinking about helping, this is the way for us to make up that last $100K. This classmate wants to remain anonymous (no, it’s not the same one as in the last campaign).

We have until the end of this year to close out our pledges for this current campaign, but my personal goal is for the class to reach goal BEFORE our class meeting so that I can report that the class of 1972 has met or exceeded its goal in every 5-year cycle for the last 20 years!

So, if you are interested in participating in the class “plank-owner” campaign but have not yet gotten around to filling out the pledge form, please consider doing so now by clicking on the link provided above. If you have an IRA, please consider saving yourself the income tax “hit” by using the QCD tool to donate directly from your IRA.

Thanks again for your support on this. Let me know if you have questions or need some help!

Jeff Beard (jeffreyb72@icloud.com).

Navy Football 2022

Posted: 5/27/2022

For: Immediate Release

Sent: May 27, 2022

Contact: Scott Strasemeier (410) 293-8775

CBS Sports Network and ESPN / ABC Announce Game Times for Eight Navy Football Games

ANNAPOLIS, Md.—CBS Sports Network and ESPN / ABC announced game times for Navy’s five home games at Navy-Marine Corps Memorial Stadium, the Notre Dame game at M&T Bank Stadium in Baltimore and the Friday, Oct. 14 game at SMU.

Navy’s season opener on Sept. 3 against Delaware will kick at 12 noon and air on CBS Sports Network. The other three games on CBS Sports Network (Sept. 10 vs. Memphis, Oct. 8 vs. Tulsa and Oct. 29 vs. Temple) will kick at 3:30 PM.

Navy’s game at SMU on Friday, Oct. 14 will kick at 7:30 PM (ET) and will be televised by ESPN.

ESPN selected the Houston game on Oct. 22 as its Navy home game to televise. That game will kick at 12 noon and will be televised on the ESPN Family of Networks.

The Notre Dame game will be televised by ABC or ESPN on Nov. 12 at 12 noon.

Yesterday, CBS announced the Navy at Air Force game on Oct. 1 will kick at 12 noon (ET), 10:00 AM (MT) and the Army-Navy Game presented by USAA on Dec. 10 will kick at 3 PM.

Season and mini-plan tickets are on sale now at navysports.com: https://tinyurl.com/npabpbx7 or by calling 1-800-US4-NAVY.

2022 Navy Football Schedule

Date Opponent Location Time TV

Sept. 3 Delaware Annapolis, Md. 12 noon CBS Sports Network

Sept. 10 Memphis Annapolis, Md. 3:30 PM CBS Sports Network

Sept. 24 at East Carolina Greenville, N.C. TBA TBA

Oct. 1 at Air Force Colorado Springs, Col. 12 noon CBS

Oct. 8 Tulsa Annapolis, Md. 3:30 PM CBS Sports Network

Oct. 14 at SMU Dallas, Texas 7:30 PM ESPN

Oct. 22 Houston Annapolis, Md. 12 noon ESPN Family of Networks

Oct. 29 Temple Annapolis, Md. 3:30 PM CBS Sports Network

Nov. 5 at Cincinnati Cincinnati, Ohio TBA TBA

Nov. 12 vs. Notre Dame Baltimore, Md. 12 noon ABC or ESPN

Nov. 19 at UCF Orlando, Fla. TBA TBA

Dec. 3 AAC Championship Game TBA 4:00 PM ABC

Dec. 10 vs. Army Philadelphia, Pa. 3:00 PM CBS

Feb ’22 update: Class of ’72 Plank-Owner Campaign Project

Posted: 1/31/2022

Happy (Chinese) New Year & welcome to 2022, meaning we’re approaching our 50threunion in October. At this year’s reunion business meeting, I’ll provide the entire class a report regarding how we’ve done with respect to our last successful campaign (the ’72 Athletic Facility & Excellence) and our current Class of ’72 Plank-Owner Campaign.

But first, some nautical trivia: (1) A Sailing vessel having two masts, the ‘aft’, i.e., rear mast, being taller than the front (for’ard) mast is called a ______________? and (2) The mount used to house the steering compass is called a ________? (Answers at the end).

Regarding the last five-year campaign (“72 Athletic Facility & Excellence), you all know we broke the record on this one. No class has ever had a more successful campaign in the entire history of USNA class campaigns. We raised $6.8 Million (goal was $5 Million), successfully funded four components (the Sports & Rehabilitation Centre – $2.5 Million; DMP – $1.8 Million; Project-Based Learning – $ 750K; & the Naval Academy Fund – $ 1.7 Million). We also had 404 class donors (almost 50% of the eligible class). When you get into the Yard this fall, go check out the Ricketts Hall renovation and see the plaque outside our Centre, which reads:

The Class of 1972 is proud to sponsor this Sports Centre that will sharpen the competitive advantage and serve as a safe harbour of physical restoration for all members of the Brigade of Midshipmen. While participating in varsity, club, and intramural sports at the Naval Academy, we honed a competitive attitude, learned the importance of placing team over self, discovered the transforming power of purposeful daily drudgery, and reinforced the impact of effective leadership skills. We all know from personal experience that these endeavours prepared us for the challenges we faced as officers in the Navy and Marine Corps and as business and community leaders. We are confident this Centre will support this vital physical development of Midshipmen in the years to come.

Regarding our current campaign (Class of ’72 Plank-Owner Project), we’re not doing quite as well. To-date we’ve raised $ 464 K (of a $750 K goal) and 31 classmates have participated thus far. My hope is that we can stir up some interest, now that it’s a reunion year… and so that I don’t have to report back to you in October that we fell short of goal (for the first time) in our last & final campaign! So, cutting to the chase, here’s my pitch:

- We’re raising funds for the new Alumni Association & Foundation Centre (AAFC),

which is currently

which is currently

being constructed outside the Yard & across the road from the baseball field. It’s a $36 Million project and many classes are helping to fund it. The facility—targeted to open in 2023—will provide a premium venue for a wide range of alumni events, streamline, and enhance Alumni Association and Foundation operations and provide an ideal space to celebrate alumni achievements in all aspects of society—all of which help support the Naval Academy mission and strengthen the alumni network.

- Our $750 K will go toward: (1) A class naming opportunity ($500 K) for a conference room AND (2) a $250 K class major “plank-owner”

plaque that would be displayed with other class plaques in the North Garden Terrace (see images below). Funds raised so far mean we have the “plaque”, but we are not quite halfway toward the conference room goal.

plaque that would be displayed with other class plaques in the North Garden Terrace (see images below). Funds raised so far mean we have the “plaque”, but we are not quite halfway toward the conference room goal.

- For those of you that pledged to our last successful campaign, the last pledge comes due this year (2022). Please consider extending your pledge to this new campaign from 2023 onward (up to five years). Here’s a like to our class pledge form, which can be filled out online, saved, and sent directly to USNA via an e-mail: http://www.bit.ly/72pledgeform

- Some of you are fortunate enough to have IRAs to help fund your retirement but may find you don’t really need to draw down the full required minimum distribution (RMD) which will begin for us at age 72. This RM

D will be counted by the IRS as income, meaning you’ll need to report it for both state and federal taxes. Please consider using a portion of your RMD as part of a qualified charitable deduction (QCD), allowing you to avoid paying taxes on the amount being donated, even if you file the short form. Here’s a link with more information on the QCD: http://www.usna.com/plannedgivingIRAQCD. If you’d like to do this, but are confused, let me know & I’ll get you some help. - Of course, there’s always the option to send in a one-time check or VISA donation via the link above.

So, that’s my pitch. if you are interested in participating in this new class campaign but have not yet gotten around to filling out the pledge form, please consider doing so now by clicking on the link provided. If you have an IRA, please consider saving yourself the income tax “hit” by using the QCD tool to donate directly from your IRA.

The answers to the quiz: (1) A sailing vessel having two masts, with the rear mast being taller than the front is called a Schooner. Other vessels such as ketches, yawls, and brigs also have 2 masts, but do not meet the description of the schooner. (2) The mount used to house the steering compass is called a binnacle. On smaller vessels the steering compass is normally fixed to the cockpit bulkhead rather than on a separate mount.

Thanks again for your help & support on this. Let me know if you have questions or need some help! Jeff Beard (jeffreyb72@icloud.com).

Class of 72 Ship’s Stores

Posted: 1/21/2022

“Classmates,

The Class of ‘72 Ship’s Stores for 50th Reunion Merchandise are now opened for business!

For clothing items go to http://www.usnaclasstore.com/72store.html and for non-clothing items go to https://www.foreverfirstie.com/product/class-packages.

Our clothing supplier, Anchor Enterprises, is conducting an “early bird” campaign, featuring personalized football jerseys. These highly customized jerseys have a long lead time and a minimum order requirement, so orders for this “early bird” sales campaign will only be accepted until February 13, 2022. Again, the web address is: http://www.usnaclasstore.com/72store.html

Finally, we welcome ForeverFirstie to the Class of ’72 Ship’s Store lineup. As a reminder, their link address is https://www.foreverfirstie.com/product/class-packages. Here you will find glasses, mugs, decals, etc. You can order a “package” specially selected for our class or you can purchase separate items from an array of quality merchandise. You also have a choice of two logos on your choices; either our class crest or the new 50th reunion logo created by Gary Besaw.

Don’t be a “straggler” – get your orders in now!”

CLASS OF ’72 DMP FOR CHARACTER EDUCATION LETTER

Posted: 8/29/2021

CAPT THOMAS L. ROBERTSON ’89, USN

To the Class of 1972,

Below is a summation of my Academic Year 2020-2021 efforts as the Class of 1972 Distinguished Military Professor for Character Education.

TEACHING

Teaching and mentoring midshipmen is at the core of my responsibilities as your Distinguished Military Professor. I focused my teaching efforts on two different courses this academic year. My first class was the youngster NE203 Ethics and Moral Reasoning for the Naval Leader course, which is a foundational study of the application of ethical thought and character development as it pertains to future Navy and Marine Corps junior officers. This core NE203 course just completed an extensive curriculum review cycle. I was a voting member on the small faculty team charged with updating the course material to reflect the most current developments in ethical thought as well as updating case studies to reflect recent events in the fleet. I am happy to report that our revised curriculum was recently approved by the Yard-wide curriculum committee. Thanks to the efforts of many faculty members, the midshipmen will continue to receive the most up-to-date material in their study of military leadership and ethics.

My second course was HH386 History of Modern Counterinsurgency. This course is an upper-level history of irregular warfare from post-World War II through present day conflicts. The curriculum offered numerous opportunities to discuss the complex combat environments that these midshipmen might encounter and to allow them to experience, vicariously, the difficulties of leading well in these environments. Teaching this academic year amidst the COVID pandemic presented many unique challenges — from fully online virtual teaching to masked live teaching, to half of a class section in-person while the other class members tuned in virtually. I am proud of both the faculty and the midshipmen for their resilience and persistence in moving forward with the academic and professional curriculum despite these challenges.

In addition to teaching departmental courses, I also advised several midshipman research teams working on technical capstone research projects. My advisory work with the technical capstone research projects allows me to “have a voice” in multiple academic departments around the Yard as well as giving me the opportunity to send midshipmen summer interns to work on priority projects with Naval Special Warfare Command. These efforts all contribute to the “Character in the Curriculum” program that I lead with the goal of synchronizing character initiatives with the larger USNA academic and professional programs.

CHARACTER PROGRAM INITIATIVES

Even with Covid-19 restrictions, the USNA Character Development Program had a very successful year supporting the Naval Academy’s Strategic Plan. Beginning in July 2020, while following strict COVID protocols, my team delivered Character Development Lessons to the 30 plebe platoons of the Class of 2024. The purpose of these lessons is to inspire the newest midshipman candidates to become standard-bearers of the naval profession as they join the Brigade at the start of the fall semester. Unfortunately, COVID required us to cancel each plebe company traveling on a Saturday morning to the United States Holocaust Memorial Museum for a tour and educational program designed specifically for military personnel. This training took place virtually thanks to the flexibility and professionalism of the museum staff.

For the Firsties, typically every member of the Class of 2021 would have attended a daylong John R. Elliott Character Capstone Seminar. These seminars help develop collaboration in the field of ethical leadership as we train the 1/C to think like officers and begin their transition from being midshipmen to commissioned officers. We had to revert to virtual seminars this academic year. To increase the relevance of the training, we designed a new mentoring series to supplement the virtual seminars titled “The Character of a Warfighter.” During these mentoring sessions, we invited active duty officers from specific warfare communities to join us online to mentor small groups of midshipmen aspiring to enter these communities. The midshipman reviews of these sessions were overwhelmingly positive as they felt they were able to connect with “the fleet” while asking questions of both junior and senior officers in whose steps they hoped to soon walk.

Our plans for the Class of 2022 also did not escape COVID-19 mitigation. Normally, the USNA Character Development Program hosts the Travis Manion Foundation immediately after Spring Break to deliver the “If not me, then who…” inspirational talk to the 2/C. The purpose of the lecture is to inspire the soon-to-be Firsties to step up into their proper leadership role within the Brigade. This year, we had to move the lecture date and abbreviate the live lecture delivery, all while socially distancing the Class of 2022 throughout Alumni Hall — but we were able to move forward with this important lecture series which had been cancelled last academic year.

Finally, as the Distinguished Military Professor for Character Education, I take a leading role in curriculum development. We are excited that we will soon be integrating a new “Warrior Toughness” curriculum in the Plebe Summer Character Development lessons for the Class of 2025. This new material is in the final stages of development as I write and will be implemented in July 2021 when the Class of 2025 reports for Plebe Summer in just a few short weeks. We expect immediate benefits from this program as we seek to expand the implementation of “Warrior Toughness” initiatives across all aspects of Plebe training.

THANK YOU

With that, I would like to say again, thank you. Thank you, Class of 1972, for your faith in me. I look forward to another year as your DMP and to seeing many of you at occasional events (or even a football tailgate as we begin to re-open in Maryland) around Annapolis.

Until then, fair winds and following seas, CAPT Thomas L. Robertson ’89, USN

August 2021 update: Class of ’72 Plank-Owner Campaign Project

My last memo was in April when I reported that we had raised $215 K of our $750 K goal to get our name displayed within the new Alumni Association and Foundation Center (AAFC), which has so far raised $3.5 Million of the $7 Million still needed (total cost $36 Million). Much preparation work has been done, and the official ground-breaking for the new center will take place September 1st with an anticipated completion date in late 2022/early 2023.If we can raise the funds, our $750 K will go toward: (1) A class naming opportunity ($500 K) for a conference room AND (2) a $250 K class major “plank-owner” plaque that would be displayed with other class plaques in the North Garden Terrace. Here are 3 representative images (the AAFC, a conference room and the donor wall):

So, how’s the Foundation and our class doing so far? The Foundation has 27 classes running campaigns to raise $8 Million (so far, $3.5 million raised). We’re 1 of the 27, and our $750 K campaign has so far raised $341 K from 33 classmates (so, we’re not quite halfway there). We’ve raised enough for our “plank-owner” plaque…but not enough to fund the ’72 conference room. This campaign runs through December 31, 2022, so we still have 17 months to reach our goal. “Pledges” then run from 2023 to 2027 (can be designated for any one of those five years…or pledged in equal (or unequal) instalments across the entire five years). Our last campaign set a goal of $5 Million, ended up raising $7 M, and will end next year (2022).

Many of you have been historical donors and continue to have a sincere interest in continuing to support USNA going forward. Some of you may have limitations regarding your capability or perhaps the timing of your support, so here’s some ideas I’m asking classmates to consider as we go forward:

- For those of you that pledged to our last successful campaign, that last pledge will be in 2022. Please consider extending that pledge to this new campaign from 2023 onwards. Here’s a link to our class pledge form for this new campaign, which can be filled out online, saved, and sent directly to USNA via e-mail: http://www.bit.ly/72pledgeform

- Some of you are fortunate enough to have IRAs to help fund your retirement but may find you don’t really need to draw down the full required minimum distribution (RMD) which will begin soon. This RMD will be counted by the IRS as income, meaning you’ll need to report it for both state and federal taxes. Please consider using a portion of your RMD as part of a qualified charitable deduction (QCD), allowing you to avoid paying taxes on the amount being donated, even if you file the short form. Here’s a link with more information on the QCD: http://www.usna.com/plannedgivingIRAQCD

- Of course, there’s always the option to send in a one-time check or VISA donation via the link above.

My point is, if you are interested in participating in this new class campaign but have not yet gotten around to filling out the pledge form, please consider doing so now by clicking on the link provided. If you have an IRA, please consider saving yourself the income tax “hit” by using the QCD tool to donate directly from your IRA.

That’s my summer update. This is our last official fundraiser. Please consider joining us prior to next year’s 50th reunion, where I’ll report our results. Our class is currently recognized with a plaque on the new Sports & Rehabilitation Center. Ideally our class can achieve two additional naming opportunities on display at the new Alumni Association and Foundation Center.

Let me know if you have questions or need further info. Contact me @ jeffreyb72@icloud.com.

Thanks, Jeff Beard

April 2021 Update: Class of ’72 Plank-Owner Project update

Posted: 4/3/2021

I sent around a memo in January, then followed up with one in February announcing another class project with the opportunity to get our name displayed within the new Alumni Association and Foundation Center (AAFC), which still needs $7 Million (it costs $36 Million) to be completed. We set a $750K goal to see if we could achieve both: (1) A class naming opportunity ($500K) for a conference room inside the AAFC facility AND (2) a $250K class major “plank-owner” plaque that would be displayed with other class plaques in the North Garden Terrace, located on the front of the building

I also gave you a nautical teaser question…and by popular request here’s another one: What’s the history behind the term “touch and go”? (answer below).

Anyway, regarding our status. We’ve raised (through mid-March), $215K, which is short of the $250K needed for the plank-owner plaque, and of course nothing yet for the conference room to bear our name. It’s still early days, so I’m hoping the pledges will pick up this spring. Since our 50th Reunion Class project ends in 2022, my pitch has been to encourage those of you that are interested to consider extending your pledge AFTER 2022, when your 50th Reunion pledge expires. The AAFC building will be outside the USNA gate, and across from the baseball field. Here’s the artist rendering plus a reminder regarding where our conference room and plank-owner plaque would be displayed:

A number of you have written back inquiring more about the QCD (Qualified Charitable Deduction). It turns out that our age (over 70 years) makes this a viable and tax-efficient vehicle for donations to a qualified charity. Let me explain the logic again. At age 72 (for most of us, that’s in 2022), we’re going to be forced to anyway withdraw from our IRAs what’s called a Required Minimum Distribution (RMD), which will be reported as “income” and meaning you’ll need to pay both federal and state taxes on that income at your marginal tax rate. If you don’t make the withdrawal, the IRS will impose a 50% penalty. The ONLY WAY to avoid counting this RMD as income and avoiding the subsequent tax is through a donation to a qualified charity (i.e., The USNA Foundation). There’s a vehicle called the QCD (Qualified Charitable Deduction) that can be used to transfer money directly from your IRA custodian to a qualified charity. The amount transferred is then exempt from being reported as income, meaning you will not have to pay tax on it. Even if you don’t itemize, you’ll be able to take advantage of this tool. The Foundation has come up with a helpful webpage which explains this in further detail, so if you’re interested, type this into your browser to learn more about how it all works: https://usna.planmylegacy.org/ira-qcd-(qualified-charitable-distribution).

My point is, if you are interested in participating in the class project and have an IRA you might as well use the QCD to donate directly from your IRA so that you can avoid the extra income “hit”. HOW DO YOU DO THAT?Here’s a link to our class pledge form: http://www.bit.ly/72AAFpledge. Call it up on your browser, fill it out online, save the PDF changes, then attach the file in an e-mail to Clay Evans at the Foundation (clay.evans@usna.com).

That’s my pitch. Please consider joining in on this so we can have two additional naming opportunities for our class on display at the new Alumni Association and Foundation Center.

Let me know if you have questions or need further info. Contact me at: jeffreyb72@icloud.com.

Thanks, Jeff Beard

Hello vaccine, goodbye pandemic (part two)

Posted: 2/14/2021

So, who’s idea was it anyway to sing “Happy Birthday” while washing your hands? Now every time I go to the bathroom, my grandkids expect me to walk out with a cake…ok, ok, now that I’ve got your attention, I continue to hope 2021 finds you in good health and following safe practices.

Nautical teaser question: What’s the history behind the term “hard up”? (answer below).

Last month I provided an update on our 50th Reunion Legacy Campaign and introduced a new mini campaign for those classmates who would consider extending their pledge or otherwise financially support the funding of the new Alumni Association and Foundation Center (AAFC), which still needs $7 Million to be completed. My pitch is to encourage those of you that are interested to consider extending your pledge AFTER 2022, when your 50thReunion pledge expires.

The new Alumni Center costs $36 Million, and they’re $7 Million short. Dan Quatrini (our guy at the Foundation) is rallying the classes to help support this gap through various class recognition campaigns. After sending around my first e-Gouge, coupled with a separate e-mail to a subset of classmates that have a giving history, I’ve gotten some great feedback and interest from (so far) around 30 of you. Based on your feedback and interest, I now believe we could realistically set a $750K goal that would get us both: (1) A class naming opportunity ($500K) for a major conference room inside the AAFC facility AND (2) a $250K class major “plank-owner” plaque that would be displayed with other class plaques in the North Garden Terrace, located on the front of the building (see both options below):

There are two things going for our class that make this $750K goal feasible: (1) timing and (2) our age. Let me explain.

- Timing: This year, 2021, is the fourth year of our 50th Reunion Legacy Campaign, meaning the last of your pledges would be paid out in 2022. We’re not planning on running another “major” campaign, instead we’ll be running more minor or opportunistic campaigns. So, my pitch is, I’m asking if you would extend the same pledge you made for the current campaign (2018=>2022) to this next campaign for four years (2023=>2026) but redirect that extension to the Foundation’s $7 Million campaign goal which expires in 2026.

- Age: In my last e-Gouge, and for those of us that have IRA accounts set up, I made you aware that, at age 72 (for most of us, that’s in 2022), we’re going to be forced to withdraw from our IRAs what’s called a Required Minimum Distribution (RMD), which will be reported as “income” and meaning you’ll need to pay both federal and state taxes on that income at your marginal tax rate. If you don’t make the withdrawal, the IRS will impose a 50% penalty. To roughly calculate your RMD, take the value of your IRA today, top it up a bit for some growth until you’re age 72, then divide by 25.6 (from the IRS tables). While you’re allowed to withdraw money today, that calculated number is the amount that MUST be withdrawn at age 72 and beyond. The ONLY WAY to avoid counting this RMD as income and avoiding the subsequent taxes is through a donation to a qualified charity (i.e., The USNA Foundation). Here’s how:

- There’s a vehicle called the QCD (Qualified Charitable Deduction) that can be used to transfer money directly from your IRA custodian to a qualified charity. The amount transferred is then exempt from being reported as income, meaning you will not have to pay tax on it. Even if you don’t itemize, you’ll be able to take advantage of this tool.

- Turns out that we can begin using a QCD beginning at age 70.5 (so, many of us today) to draw down our IRAs. Even though you may not be required to make a minimum level of withdrawal this year, you can still use the QCD today to begin drawing down your IRA. In a nutshell, here are the QCD requirements:

- You must be 70½ or older to be eligible to make a QCD. (Check)

- QCDs are limited to the amount that would otherwise be taxed as ordinary income. This excludes non-deductible contributions. (this means the RMD from your IRA).

- The maximum annual amount that can qualify for a QCD tax deduction is $100,000. This applies to the sum of QCDs made to one or more charities in a calendar year. (If, however, you file taxes jointly, your spouse can also make a QCD from her own IRA within the same tax year for up to $100,000.) (if your RMD is above $100,000 per year, I’m impressed).

- For a QCD to count towards your current year’s RMD, the funds must come out of your IRA by your RMD deadline, generally December 31. (so, you can’t wait until just before you file your taxes on April 15thof the following year).

My point is, if you have an IRA and are anyway going to be donating to a charity or USNA, you might as well use the QCD to donate directly from your IRA so that you can avoid the extra income “hit”. HOW DO I DO THAT? You may ask. I’m including a link to our class pledge form: http://www.bit.ly/72AAFpledge that I’m asking you to fill out online (save the completed PDF with changes) then attach the file in an e-mail to Clay Evans (clay.evans@usna.com).

That’s my pitch. Please consider joining in on this so we can have two additional naming opportunities for our class on display at the new Alumni Association and Foundation Center.

Let me know if you have questions or need further info. Contact me at: jeffreyb72@icloud.com.

Thanks, Jeff Beard