April 2021 Update: Class of ’72 Plank-Owner Project update

Posted: 4/3/2021

I sent around a memo in January, then followed up with one in February announcing another class project with the opportunity to get our name displayed within the new Alumni Association and Foundation Center (AAFC), which still needs $7 Million (it costs $36 Million) to be completed. We set a $750K goal to see if we could achieve both: (1) A class naming opportunity ($500K) for a conference room inside the AAFC facility AND (2) a $250K class major “plank-owner” plaque that would be displayed with other class plaques in the North Garden Terrace, located on the front of the building

I also gave you a nautical teaser question…and by popular request here’s another one: What’s the history behind the term “touch and go”? (answer below).

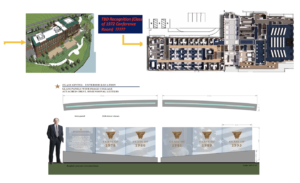

Anyway, regarding our status. We’ve raised (through mid-March), $215K, which is short of the $250K needed for the plank-owner plaque, and of course nothing yet for the conference room to bear our name. It’s still early days, so I’m hoping the pledges will pick up this spring. Since our 50th Reunion Class project ends in 2022, my pitch has been to encourage those of you that are interested to consider extending your pledge AFTER 2022, when your 50th Reunion pledge expires. The AAFC building will be outside the USNA gate, and across from the baseball field. Here’s the artist rendering plus a reminder regarding where our conference room and plank-owner plaque would be displayed:

A number of you have written back inquiring more about the QCD (Qualified Charitable Deduction). It turns out that our age (over 70 years) makes this a viable and tax-efficient vehicle for donations to a qualified charity. Let me explain the logic again. At age 72 (for most of us, that’s in 2022), we’re going to be forced to anyway withdraw from our IRAs what’s called a Required Minimum Distribution (RMD), which will be reported as “income” and meaning you’ll need to pay both federal and state taxes on that income at your marginal tax rate. If you don’t make the withdrawal, the IRS will impose a 50% penalty. The ONLY WAY to avoid counting this RMD as income and avoiding the subsequent tax is through a donation to a qualified charity (i.e., The USNA Foundation). There’s a vehicle called the QCD (Qualified Charitable Deduction) that can be used to transfer money directly from your IRA custodian to a qualified charity. The amount transferred is then exempt from being reported as income, meaning you will not have to pay tax on it. Even if you don’t itemize, you’ll be able to take advantage of this tool. The Foundation has come up with a helpful webpage which explains this in further detail, so if you’re interested, type this into your browser to learn more about how it all works: https://usna.planmylegacy.org/ira-qcd-(qualified-charitable-distribution).

My point is, if you are interested in participating in the class project and have an IRA you might as well use the QCD to donate directly from your IRA so that you can avoid the extra income “hit”. HOW DO YOU DO THAT?Here’s a link to our class pledge form: http://www.bit.ly/72AAFpledge. Call it up on your browser, fill it out online, save the PDF changes, then attach the file in an e-mail to Clay Evans at the Foundation (clay.evans@usna.com).

That’s my pitch. Please consider joining in on this so we can have two additional naming opportunities for our class on display at the new Alumni Association and Foundation Center.

Let me know if you have questions or need further info. Contact me at: jeffreyb72@icloud.com.

Thanks, Jeff Beard

« Hello vaccine, goodbye pandemic (part two)