Hello vaccine, goodbye pandemic (part two)

Posted: 2/14/2021

So, who’s idea was it anyway to sing “Happy Birthday” while washing your hands? Now every time I go to the bathroom, my grandkids expect me to walk out with a cake…ok, ok, now that I’ve got your attention, I continue to hope 2021 finds you in good health and following safe practices.

Nautical teaser question: What’s the history behind the term “hard up”? (answer below).

Last month I provided an update on our 50th Reunion Legacy Campaign and introduced a new mini campaign for those classmates who would consider extending their pledge or otherwise financially support the funding of the new Alumni Association and Foundation Center (AAFC), which still needs $7 Million to be completed. My pitch is to encourage those of you that are interested to consider extending your pledge AFTER 2022, when your 50thReunion pledge expires.

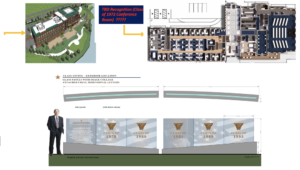

The new Alumni Center costs $36 Million, and they’re $7 Million short. Dan Quatrini (our guy at the Foundation) is rallying the classes to help support this gap through various class recognition campaigns. After sending around my first e-Gouge, coupled with a separate e-mail to a subset of classmates that have a giving history, I’ve gotten some great feedback and interest from (so far) around 30 of you. Based on your feedback and interest, I now believe we could realistically set a $750K goal that would get us both: (1) A class naming opportunity ($500K) for a major conference room inside the AAFC facility AND (2) a $250K class major “plank-owner” plaque that would be displayed with other class plaques in the North Garden Terrace, located on the front of the building (see both options below):

There are two things going for our class that make this $750K goal feasible: (1) timing and (2) our age. Let me explain.

- Timing: This year, 2021, is the fourth year of our 50th Reunion Legacy Campaign, meaning the last of your pledges would be paid out in 2022. We’re not planning on running another “major” campaign, instead we’ll be running more minor or opportunistic campaigns. So, my pitch is, I’m asking if you would extend the same pledge you made for the current campaign (2018=>2022) to this next campaign for four years (2023=>2026) but redirect that extension to the Foundation’s $7 Million campaign goal which expires in 2026.

- Age: In my last e-Gouge, and for those of us that have IRA accounts set up, I made you aware that, at age 72 (for most of us, that’s in 2022), we’re going to be forced to withdraw from our IRAs what’s called a Required Minimum Distribution (RMD), which will be reported as “income” and meaning you’ll need to pay both federal and state taxes on that income at your marginal tax rate. If you don’t make the withdrawal, the IRS will impose a 50% penalty. To roughly calculate your RMD, take the value of your IRA today, top it up a bit for some growth until you’re age 72, then divide by 25.6 (from the IRS tables). While you’re allowed to withdraw money today, that calculated number is the amount that MUST be withdrawn at age 72 and beyond. The ONLY WAY to avoid counting this RMD as income and avoiding the subsequent taxes is through a donation to a qualified charity (i.e., The USNA Foundation). Here’s how:

- There’s a vehicle called the QCD (Qualified Charitable Deduction) that can be used to transfer money directly from your IRA custodian to a qualified charity. The amount transferred is then exempt from being reported as income, meaning you will not have to pay tax on it. Even if you don’t itemize, you’ll be able to take advantage of this tool.

- Turns out that we can begin using a QCD beginning at age 70.5 (so, many of us today) to draw down our IRAs. Even though you may not be required to make a minimum level of withdrawal this year, you can still use the QCD today to begin drawing down your IRA. In a nutshell, here are the QCD requirements:

- You must be 70½ or older to be eligible to make a QCD. (Check)

- QCDs are limited to the amount that would otherwise be taxed as ordinary income. This excludes non-deductible contributions. (this means the RMD from your IRA).

- The maximum annual amount that can qualify for a QCD tax deduction is $100,000. This applies to the sum of QCDs made to one or more charities in a calendar year. (If, however, you file taxes jointly, your spouse can also make a QCD from her own IRA within the same tax year for up to $100,000.) (if your RMD is above $100,000 per year, I’m impressed).

- For a QCD to count towards your current year’s RMD, the funds must come out of your IRA by your RMD deadline, generally December 31. (so, you can’t wait until just before you file your taxes on April 15thof the following year).

My point is, if you have an IRA and are anyway going to be donating to a charity or USNA, you might as well use the QCD to donate directly from your IRA so that you can avoid the extra income “hit”. HOW DO I DO THAT? You may ask. I’m including a link to our class pledge form: http://www.bit.ly/72AAFpledge that I’m asking you to fill out online (save the completed PDF with changes) then attach the file in an e-mail to Clay Evans (clay.evans@usna.com).

That’s my pitch. Please consider joining in on this so we can have two additional naming opportunities for our class on display at the new Alumni Association and Foundation Center.

Let me know if you have questions or need further info. Contact me at: jeffreyb72@icloud.com.

Thanks, Jeff Beard

« 50th Reunion Legacy Campaign Update & Request